That $400-million suddenly looks like pocket change by comparison to what Intel is now doing in the industry that makes the machines that make the CPU chips. Dutch semiconductor equipment company ASML is Europe's dominant maker of those machines that make CPU chips for companies such as AMD, ARM, and Intel, for virtually all types of computers.

Time-Traveling Two Years into the Future

The future seems to be arriving a bit ahead of schedule. Intel is now in the process, over the next few years, of investing US-$4.1-billion with a "B" in ASML, to advance the next generation of PC chip manufacturing equipment two years earlier than would otherwise be possible. In return, Intel would own 15% of ASML shares on a post-transaction basis.

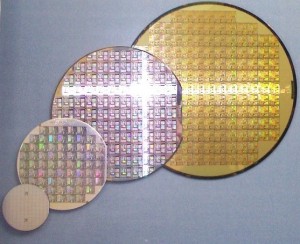

'Let's Get Small' - The Wafers & Wagers are Larger

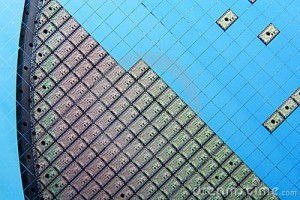

The new technology will utilize two substantial advances. The silicon wafers will be larger, and better techniques and equipment for extreme-ultraviolet lithography (EUL) will make the individual chips much smaller.

The new machines will produce silicon wafers that are 450-millimeters in size, as compared to the current 300-millimeter technology. Each 450-millimeter wafer will produce about twice as many chips as the 300-millimeter size. The monetary research wager being made by ASML's customers will be used to produce chips smaller than 10-nanometers, as compared to Intel's current 22-nanometer process. Intel is expected to move to a 14-nanometer process in 2013 while using its current equipment.

'The Chips are Down'

Now that Intel has made its bet by literally putting down US-$4.1-billion in chips in the game, getting small has never been so big. The new chip manufacturing machines will be three or four times more expensive than those currently being used, but it's really not a risky gamble. Brian Krzanich, Intel's Chief Operating Officer, says the new equipment will provide a reduction of 30% to 40% in the cost of a CPU chip, and that of course would greatly reduce prices on laptops, tablets, and smartphones. Richard Windsor, Nomura Group's global technology specialist said: "We're talking about $50 tablets".

Assessment

Intel knew that the semiconductor equipment maker, ASML, could not advance the new technology fast enough to meet Intel's needs without a huge cash injection. Forward looking projections most certainly indicated that tablet, laptop, and smartphone advances would run into a brick wall without far more energy-efficient, smaller chips, and Intel's sales would suffer. The new technologies had to be developed sooner to prevent consumer and business purchases from experiencing a substantial decline, as a direct result of having nothing better to buy than the previous gadgets.

Industry analysts have said the money pumped into ASML will solidify its position as the dominant semiconductor equipment maker, while making it difficult for competitors such as Nikon and Canon to stay in business. Intel has committed in advance, to purchase orders for the new EUV and 450-nanometer equipment from ASML. Doug Freedman, an analyst for RBC Capital, thinks Intel will save approximately US-$2-billion per year with the 450-nanometer process. Freedman observed that by reducing the cost of technology in emerging markets, Intel is also helping open new markets.

VLSI Research analyst, Dan Hutcheson, said ASML's partnership with its customers taking significant equity positions, represents a "really new funding model for the industry".

The chips are down on a wafer wager & Intel is betting on the future arriving a bit ahead of schedule. They are placing that bet with cash on hand from Intel's offshore subsidiaries.

Punitive taxation is the reason many companies have cited for moving profits and cash offshore, and also jobs, physical plant, administrative operations, and manufacturing.

Laptop & Tablet Parts

Laptop & Tablet Parts